Travel and Hospitality

$9.4+ Billion

Florida, USA

- Limited Dispute Coverage: Manual processes meant only ~80% of disputes could be challenged, leaving revenue unrecovered.

- Lower Success Rates: Inconsistent data formatting and delayed submissions reduced the chances of winning disputes.

- Operational Inefficiency: High manual effort was required to extract, clean, and reconcile data across systems.

- Fragmented Systems: Critical transaction data was spread across travel booking platform, customer reservation platform and financial/operations platform, with no unified integration layer.

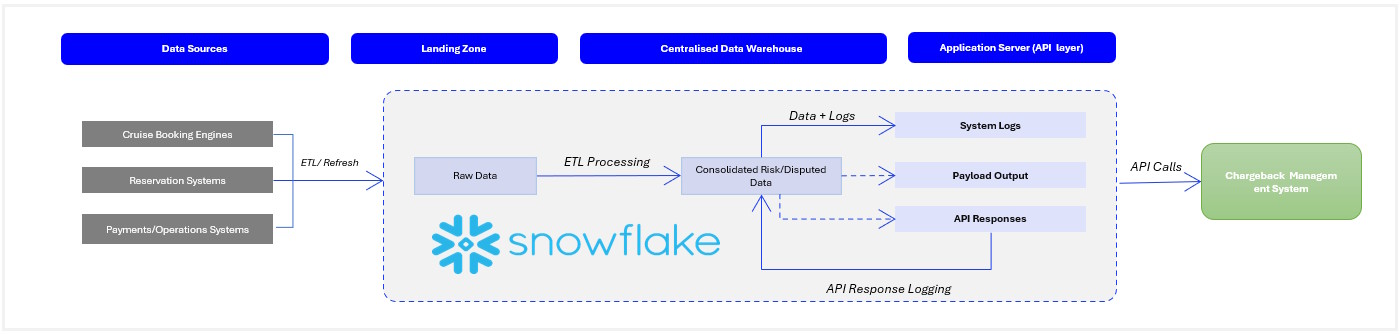

Centralized Data Integration in Snowflake

Data from all source systems were ingested and consolidated into Snowflake, ensuring a single source of truth for chargeback processing.

Stored Procedures for Data Processing

Snowflake stored procedures automated daily consolidation, reconciliation, and historical seeding of transactions, reducing manual intervention.

Python API Integration with Riskified

Purpose-built Python modules formatted chargeback data, transmitted it securely via API to Riskified, and captured response files for downstream analysis.

Automated Batch Tracking & Optimization

Timestamp-driven batch tables were implemented to monitor performance, track processing times, and ensure complete auditability.

Operational Streamlining

Automated clean-up of intermediate files and error handling reduced redundancy and improved reliability.

- Higher Win Rates: Improved data accuracy and timely submissions increased dispute success outcomes.

- 50% Reduction in Manual Effort: Freed up the payment acceptance team to focus on higher-value tasks.

- Reusable Automation Framework: Established a scalable ETL + API foundation to support future financial automation initiatives.