Consumer Packaged Goods

$400 Million

California, USA

- Unrecognized Revenue: Approximately $7M in revenue remained unrecognized across reporting periods, distorting financial reporting and impacting decision-making.

- Recording Gaps: Revenue was inconsistently recorded across core systems (Shopify & NetSuite), creating reconciliation mismatches and audit concerns.

- Limited Visibility: Finance teams lacked real-time insight into triggering transactions, delaying recognition of subscription renewals, adjustments, and customer orders.

- Operational Inefficiency: Manual, error-prone reconciliation processes consumed significant time and resources, pulling teams away from value-added analysis.

Process Discovery & Mapping

Partnered with the client to document the end-to-end revenue recognition process, identifying system-level gaps and compliance requirements.

Automated Data Extraction

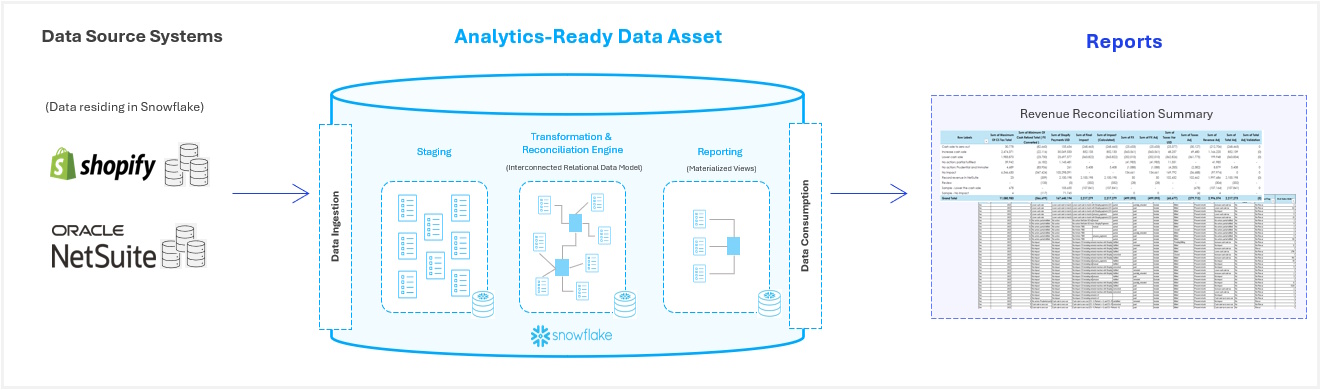

Built connectors to continuously extract revenue data from Shopify and NetSuite into a centralized, analytics-ready structure.

Pattern Analysis & Detection

Conducted detailed analysis to uncover 30+ recurring transaction patterns where revenue recognition should have been triggered but was missed.

Flexible Reconciliation Framework

Designed an automated process configurable to run daily, monthly, or quarterly, enabling adaptability to business cycles.

Scalable Architecture

Delivered a resilient solution architecture (see diagram) integrating data ingestion, transformation, validation, and reporting dashboards.

- Recovered ~$7M in unrecognized revenue in FY2024, directly improving reported financial performance.

- Enhanced efficiency of the reconciliation process, reducing manual intervention by more than 60% and enabling faster closing cycles.

- The solution was adopted as a quarterly control with the option to scale to near real-time, embedding reconciliation checks into governance frameworks.

- Improved audit readiness and compliance by providing consistent, traceable recognition rules, strengthening the client’s financial credibility.