Industry

Hospitality

Annual Revenue

$624+ Million

Location

California, USA

How we helped a client identify and resolve mismatches in the CIT process to improve reconciliation speed, accuracy, and audit confidence

Enabled automated CIT reconciliation across multiple systems, reducing unreconciled balances by ~96% (from $17M to $700K), accelerating reconciliation cycles, and ensuring audit-ready compliance.

Challenge

The client faced significant hurdles in reconciling Cash in Transit (CIT) balances across multiple systems, leading to material discrepancies and compliance risks, including:

- Unreconciled Balances: Over $17M USD remained unaccounted for in Cash in Transit balances, creating financial reporting challenges.

- Fragmented Data Sources: 500+ underlying files and multiple input systems with inconsistent formats complicated reconciliation efforts.

- Complex Accounting Processes: Manual adjustments and inconsistent reconciliation rules delayed resolution and increased error risk.

- Audit & Compliance Exposure: Lack of standardized reconciliation practices increased audit findings and weakened financial controls.

Solution

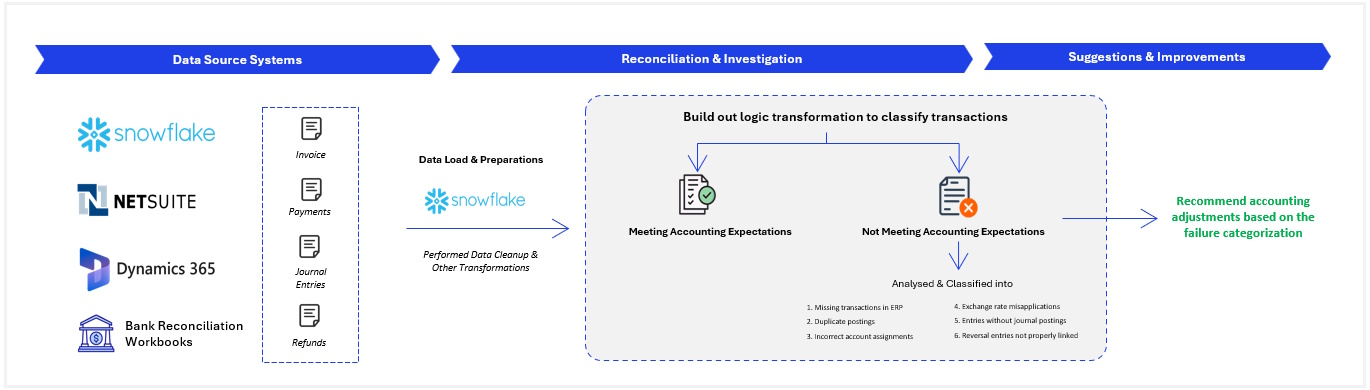

Our team partnered with client stakeholders to design an analytical reconciliation framework that streamlined exception identification and improved accuracy.

Process Understanding

Documented the client’s existing CIT reconciliation process and identified root causes of mismatches.

Analytical Review

Developed a rules-based solution to analyze posted entries and highlight discrepancies.

Exception Categorization

Classified reconciliation issues into key categories:

- Missing transactions in ERP

- Duplicate postings

- Incorrect account assignments

- Exchange rate misapplications

- Entries without journal postings

- Reversal entries not properly linked

Corrective Adjustments

Investigated mis-posted or unreconciled transactions and recommended corrective accounting actions.

Audit-Ready Framework

Established documentation and reporting to provide transparency and compliance traceability.

Reference Architecture

Result

- Improved reconciliation efficiency by streamlining mismatches and reducing manual intervention.

- Enhanced audit readiness, with standardized exception handling and transparent documentation.

- Enabled faster financial close cycles, improving visibility and confidence in reported balances.

- Shifted accounting teams from reactive reconciliation to proactive financial oversight, driving operational efficiency.